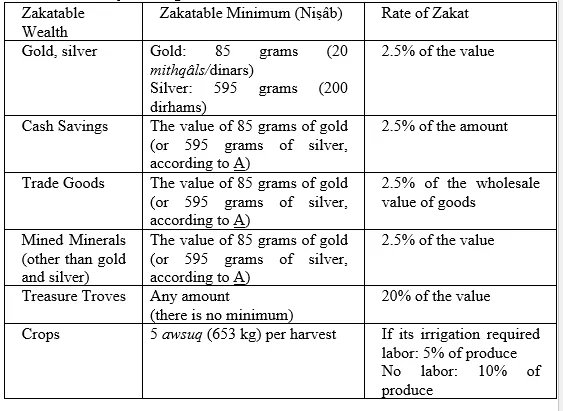

(-H): If he has multiple assets of the same category (for example: cash and cash, or cows and cows), he should add the increments to the total and pay zakat on all of it at the end of the ḥawl. (-M): Agreed with (-H) on the free-grazing livestock and with (S, A) on the rest.

The position of (H) is easier for most people to follow since the majority opinion leads to having many due dates for zakat during the year.

They agreed on the following: The passing of the ḥawl is a condition of obligation for zakat on livestock, gold and silver, and merchandise. If the money emanated from assets he had, its ḥawl is that of the original assets.

If it is of a different kind (for example: one had cows and then earned cash), it will not be zakatable until a ḥawl passes since its acquisition. If it is of the same kind, but did not emanate from the original, they disagreed as described above.